Insurance Carriers

A successful insurance carrier premium finance program consists of a few core components.

- First your distribution partners have to embrace it as an viable option to your existing payment plans

- Second it has to be easy and have sufficient integration to deliver the service

- Third the program has to have great on-going account payment servicing and value to insured’s (link)

- Fourth the carrier must be able to maximize sales and operational performance

Program Options

- Xpress Capital branded program with revenue share

- Carrier branded program with or without carrier premium finance captive

- Premium Finance joint venture blending servicing and capital needs

Organizational Impact

Sales –

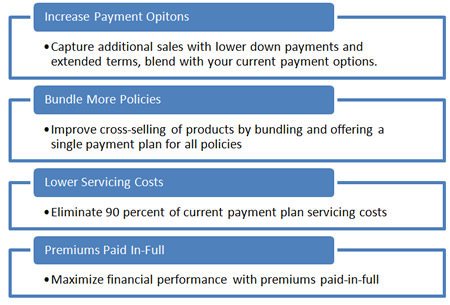

Distribution partners want more payment options to offer their clients.

- Depending on the product type, a lower down payment and extended payment term may be the difference between selling a policy or not.

- It is also known that a insured may consider a higher priced policy if that policy provides them with a lower acquisition cost and payment convenience.

- Distribution partners will place more business with a carrier who pays commissions when the premium is paid-in-full.

- For convenience policies can also be bundled on one payment plan to provide aggregate payments and better terms for insured’s which may be using multiple carriers.

Operations –

Carriers can benefit from offering premium financing as a payment alternative or option to existing payment plans. Operationally, premium financing can significantly reduce the cost associated with servicing a policy. In the process, the majority of the servicing is facilitated by Xpress Capital, including;

- Originating the agreement

- Booking the loan

- Funding the carrier the full premium

- Collecting ongoing installment payments

- Managing collections

- Managing the notices;

- Shortage

- Letter of Intent to Cancel

- Cancellation

- Reinstatement

- Commission Payments to the Agent

Carriers are left to process a single ACH payment from Xpress Capital and apply it to the account. The only additional administrative cost is incurred during the endorsement or cancellation process.

Finance

Carriers can also benefit financially by bolstering profit and lost and balance sheets.

- Increased sales revenue – more options, commissions paid up-front equals more sales

- Increase profit margin per policy – same price with lower servicing costs

- Premium paid in full at policy origination can positively impact several areas of your balance sheet including;

- Cash flow

- Short term borrowing costs

- Investment income

- Lower collection costs and write-offs

- Re-Insurer costs